This content is restricted to subscribers

Upcoming Events

-

Mid-Summer Sips Happy Hour!

July 17, 2025

4:00 pm - 6:00 pm

-

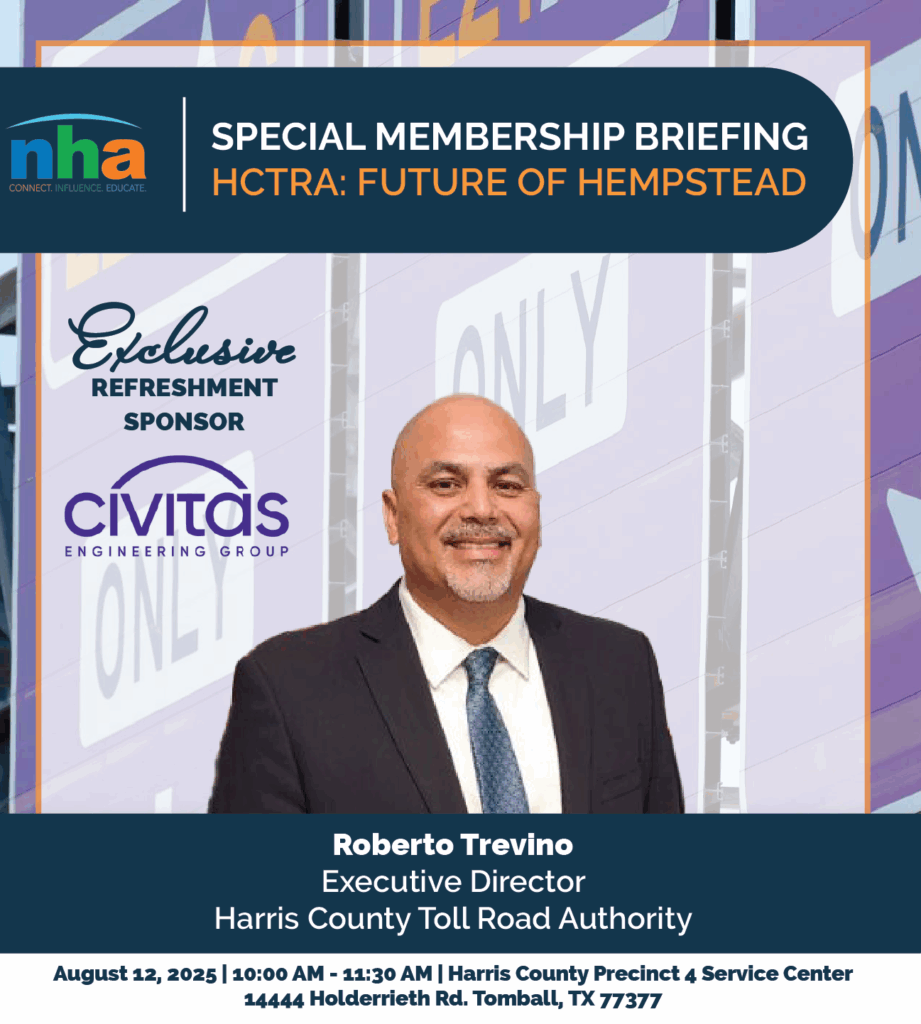

Special Membership Briefing: HCTRA - The Future of Hempstead *Members Only*

August 12, 2025

10:00 am - 11:30 am

-

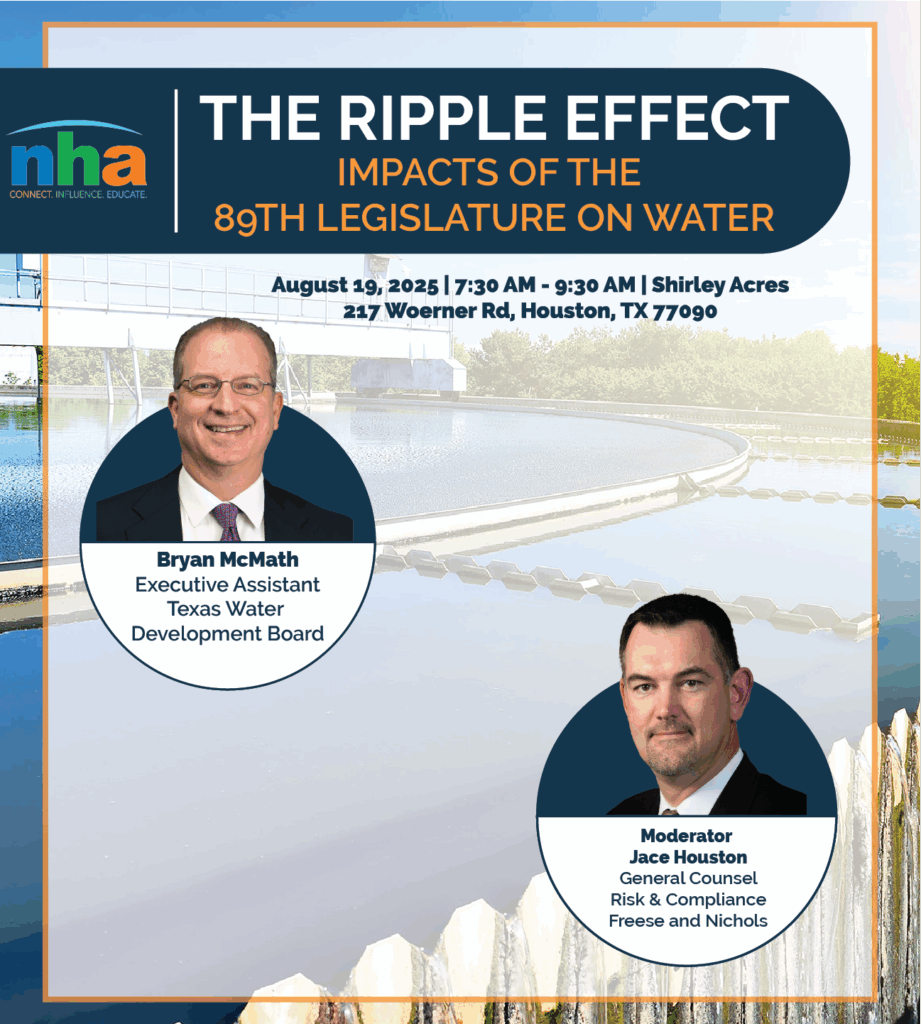

The Ripple Effect: Impacts of the 89th Legislature on Water

August 19, 2025

7:30 am - 9:30 am